The best innovations don’t come from asking consumers what they want, they come from finding hidden tensions far beyond the problems they articulate. Every brand can respond to obvious pain points, but the real opportunity lies in decoding the contradictions between what people say and what they do, uncovering the deeper tensions that shape their behaviour.

The most successful innovations don’t just address unmet needs, they reframe expectations and introduce solutions that feel better, even if they weren’t initially recognised as necessary. True innovation happens when a new way of doing things makes the old way feel instantly outdated, not because consumers asked for it, but because it redefines what good looks like.

Yet, despite this being an accepted principle among innovation practitioners, most brands still fail to systematically uncover these tensions before they invest in innovation. Instead, they rely on trends, category norms, and self-reported consumer needs, all of which create the illusion of certainty but rarely lead to market-defining success.

Traditional market research tends to focus on surface-level insights, but hidden tensions exist below the obvious, buried in the gap between what people say they want and what they actually do. According to Clayton Christensen’s Jobs to Be Done framework, consumers don’t buy products, they “hire” them to solve specific jobs in their lives. However, most innovation processes fail to recognise that consumers have become extremely sophisticated in adapting to suboptimal solutions. They have built workarounds, developed habits, and even rationalised frustrations, making these tensions difficult to spot without the right approach.

The real challenge isn’t just identifying a tension, it’s understanding which tensions have high latent demand and low competitive saturation.

What Are Hidden Tensions, Really?

Hidden tensions are moments where consumer hopes clash with reality, creating unresolved friction. These are not obvious, loudly voiced problems, but ingrained compromises that people have internalised as “just the way things are”.

For example: Convenience vs Control: Consumers want convenience without feeling like they’re sacrificing quality or control over the process.

Indulgence vs Health: They want to treat themselves, but not at the expense of their health or ethics.

Newness vs Familiarity: They crave novelty, but gravitate toward what feels safe and recognisable.

Brands that identify these tensions before they reach a crisis point are the ones that create true category-defining innovations. However, most brands rely on lagging indicators, tracking competitor moves, reacting to shifting consumer preferences, or validating ideas that are already circulating in the industry. By the time these tensions are visible in sales data or cultural discourse, they are already being solved by more forward-thinking competitors.

The following examples illustrate how the best brands identified tensions before they were obvious, setting themselves up for market leadership.

Laundry Without the Mess: The Tide Pods Story

For years, laundry detergent was focused on performance, getting clothes clean. But Tide saw that the real competitive battleground wasn’t cleaning efficacy, it was behavioural friction. Measuring detergent was messy, wasteful, and frustrating for busy consumers, yet the category had normalised this inconvenience for decades.

Tide Pods didn’t invent a new cleaning technology; they redefined the role of detergent by removing the complexity of use. Pre-measured, single-use pods combined detergent, stain remover, and brightener in one neat package, optimising the product for how consumers actually behave, not just how they should behave.

By simplifying the job consumers were hiring detergent to do, Tide eliminated a major pain point. The result? $500 million in sales in its first year and a 68% share of the unit-dose market (AdAge).

Ben & Jerry’s Non-Dairy: Indulgence Meets Ethics

As plant-based eating gained momentum, the market was filled with compromises. For years, brands had assumed that vegan consumers were willing to sacrifice indulgence in favour of ethics. The result? A category full of products that aligned with values but failed to satisfy cravings.

Ben & Jerry’s understood that the real tension was not just about plant-based vs dairy, but about the emotional gap between permission and indulgence. Their solution? A line of vegan-friendly ice creams made with almond milk that delivered the same creamy texture and indulgent flavours as the original.

By solving this tension, Ben & Jerry’s redefined what plant-based could be. As of 2024, 25% of Ben & Jerry’s global product portfolio consists of non-dairy flavours (Unilever), proving that premium and plant-based can coexist and thrive in the mainstream market.

This article is part of our Innovatively Speaking series. Explore the full library here.

Why Most Innovation Processes Fail to Spot These Tensions

If you’re waiting for consumers to tell you what they need, you’ll be waiting a long time. Hidden tensions rarely appear in traditional consumer surveys or focus groups. To uncover them, you need to decode cultural and behavioural signals before they become category norms.

Key questions to ask:

- What workarounds are consumers using today that indicate friction?

- Where are the emerging tensions that competitors haven’t yet addressed?

- What aspirational contradictions do consumers struggle to reconcile?

A study published in the Journal of Consumer Research suggests that tensions between consumer desires and practical constraints are one of the strongest indicators of unmet demand. The brands that systematically track these contradictions, rather than relying on lagging indicators like sales data, are the ones that successfully pre-empt the next wave of market growth.

Bringing This Thinking to Action

Spotting a tension is just the start. The real skill lies in knowing which tensions are worth solving. Not all consumer frustrations signal meaningful opportunities.

The best innovators:

- Validate the tension’s commercial potential before developing solutions.

- Prioritise tensions that create long-term competitive advantage, not just temporary differentiation.

- Design solutions that feel inevitable, seamlessly integrating into consumers’ lives rather than forcing behaviour change.

This is where hidden tensions meet breakthrough design. The real magic happens when your solution is not just viable, but emotionally and behaviourally irresistible.

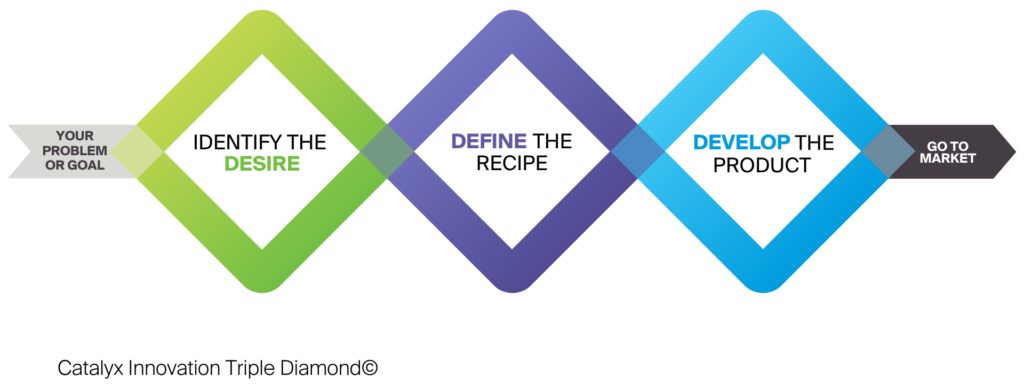

Solving Hidden Tensions with the Catalyx Innovation Triple Diamond

Hidden tensions are just one piece of the innovation puzzle. To consistently turn deep consumer understanding into successful, scalable innovation, you need a structured approach, one that ensures you’re not just reacting to trends but building predictable, high-impact success.

That’s where the Catalyx Innovation Triple Diamond comes in. This proprietary framework ensures that innovation is not left to chance, guiding brands through three critical phases:

- Identify the Desire: Identifying the strongest consumer tensions and validating their commercial potential.

- Define the Recipe: Crafting the right product formula that balances familiarity with breakthrough appeal.

- Develop the Product: Executing in a way that ensures market readiness, differentiation, and sustained success.

By embedding hidden tensions into this process, brands can move beyond reactive innovation and systematically create products that feel both inevitable and highly desirable.

Uncovering Hidden Tensions is just one of the 5 Rules for Taking Your Innovation Beyond the Obvious. These rules guide brands to move beyond the obvious and uncover hidden opportunities to create truly disruptive innovations. Ready to take the next step in your innovation journey? Let us help you expose what lies beneath the surface.

The 5 Rules for Taking Your Innovation Beyond the Obvious

- Identify Hidden Tensions – Uncover the deep-rooted needs and desires that consumers aren’t expressing outright but are driving their decisions.

- Reframe the Familiar – Look at the everyday in a new light and transform existing products or experiences to meet evolving consumer expectations.

- Balance Opposing Desires – Cater to consumer desires that once seemed mutually exclusive, such as convenience with quality or indulgence with health.

- Simplify the Complex – Reduce friction and complexity, offering consumers a seamless and intuitive experience.

- Create Emotional Resonance – Build deeper connections with consumers by tapping into their values, identity, and emotions.

Or, if you’re ready to take your next innovation bey

Find out how our approach can make your innovation success predictable

We’re ready to unlock your innovation’s success, and won’t settle until our work does just that.

Don’t just take our word for it; check out our Case Studies to discover how our award-winning approach has supercharged the success of innovations across industries.

Follow us on LinkedIn to make sure you never miss an announcement.

Let’s talk. Click here to innovate with confidence.

(Independent research conducted by Catalyx)